Fintech AI Development Services

Our tailored AI algorithms are optimized for secure, efficient, and robust financial management. Set your business apart in a competitive market by offering smarter, faster, and more reliable fintech AI development services.

Are you looking to make an intelligent leap with AI in finance?

SERVICES

Fintech AI App Development

Revamp the fintech landscape with our custom AI-driven app development, crafted to simplify complex financial processes for businesses and consumers alike. Our dedicated team is passionate about developing applications that facilitate seamless transactions and adhere to stringent regulatory standards for ultimate data protection. Utilize AI for advanced fraud detection, real-time risk assessment, and personalized financial advisory services. Our custom-built fintech solutions ensure secure, swift, and smart management of financial operations, bringing trust and innovation to your financial services. Elevate Fintech – Securely, Efficiently, Effectively.

AI-Optimized Wallet Apps

AI-Infused Accounting Apps

AI-Powered Tax Preparation Apps

Intelligent Insurance Apps

AI-powered Finance Apps

Hire Developers

Streamline payments and transactions like never before. Our custom-built AI-based Wallet Apps use predictive analytics and security algorithms to provide users with a fast, secure, and efficient payment experience. Benefit from enhanced fraud detection, user-behavior analysis, and data-driven insights.

Forget the hassle of manual entries and time-consuming audits. We build Accounting Apps utilizing machine learning algorithms to automate data entry, manage payables and receivables, and provide real-time financial insights. Smart auditing features can flag inconsistencies, helping your team address issues before they escalate.

Optimize underwriting, claims processing, and customer engagement with our custom-built AI-driven Insurance Apps. Implement AI-powered risk assessment models, smart contract validation, and personalized policy suggestions to set a new industry standard in customer satisfaction and operational efficiency.

Navigate the complexities of financial markets with our AI-powered Finance Apps. We utilize machine learning to drive investment strategies, predictive analytics for market trends, and NLP for real-time news and sentiment analysis. Stay ahead of the curve with AI that learns and adapts to changing market dynamics.

Ready to bring your tailored AI solution to life? We are a leading fintech AI company, and our team of seasoned developers specializes in leveraging the power of AI to solve complex financial problems. Hire not just developers; but your strategic partners in crafting AI solutions that will revolutionize your financial ecosystem.

AI-Optimized Wallet Apps

Streamline payments and transactions like never before. Our custom-built AI-based Wallet Apps use predictive analytics and security algorithms to provide users with a fast, secure, and efficient payment experience. Benefit from enhanced fraud detection, user-behavior analysis, and data-driven insights.

AI-Infused Accounting Apps

Forget the hassle of manual entries and time-consuming audits. We build Accounting Apps utilizing machine learning algorithms to automate data entry, manage payables and receivables, and provide real-time financial insights. Smart auditing features can flag inconsistencies, helping your team address issues before they escalate.

AI-Powered Tax Preparation Apps

Intelligent Insurance Apps

Optimize underwriting, claims processing, and customer engagement with our custom-built AI-driven Insurance Apps. Implement AI-powered risk assessment models, smart contract validation, and personalized policy suggestions to set a new industry standard in customer satisfaction and operational efficiency.

AI-powered Finance Apps

Navigate the complexities of financial markets with our AI-powered Finance Apps. We utilize machine learning to drive investment strategies, predictive analytics for market trends, and NLP for real-time news and sentiment analysis. Stay ahead of the curve with AI that learns and adapts to changing market dynamics.

Hire Developers

Ready to bring your tailored AI solution to life? We are a leading fintech AI company, and our team of seasoned developers specializes in leveraging the power of AI to solve complex financial problems. Hire not just developers; but your strategic partners in crafting AI solutions that will revolutionize your financial ecosystem.

WePay

Crypto

Wallet

P2P

Marketplace

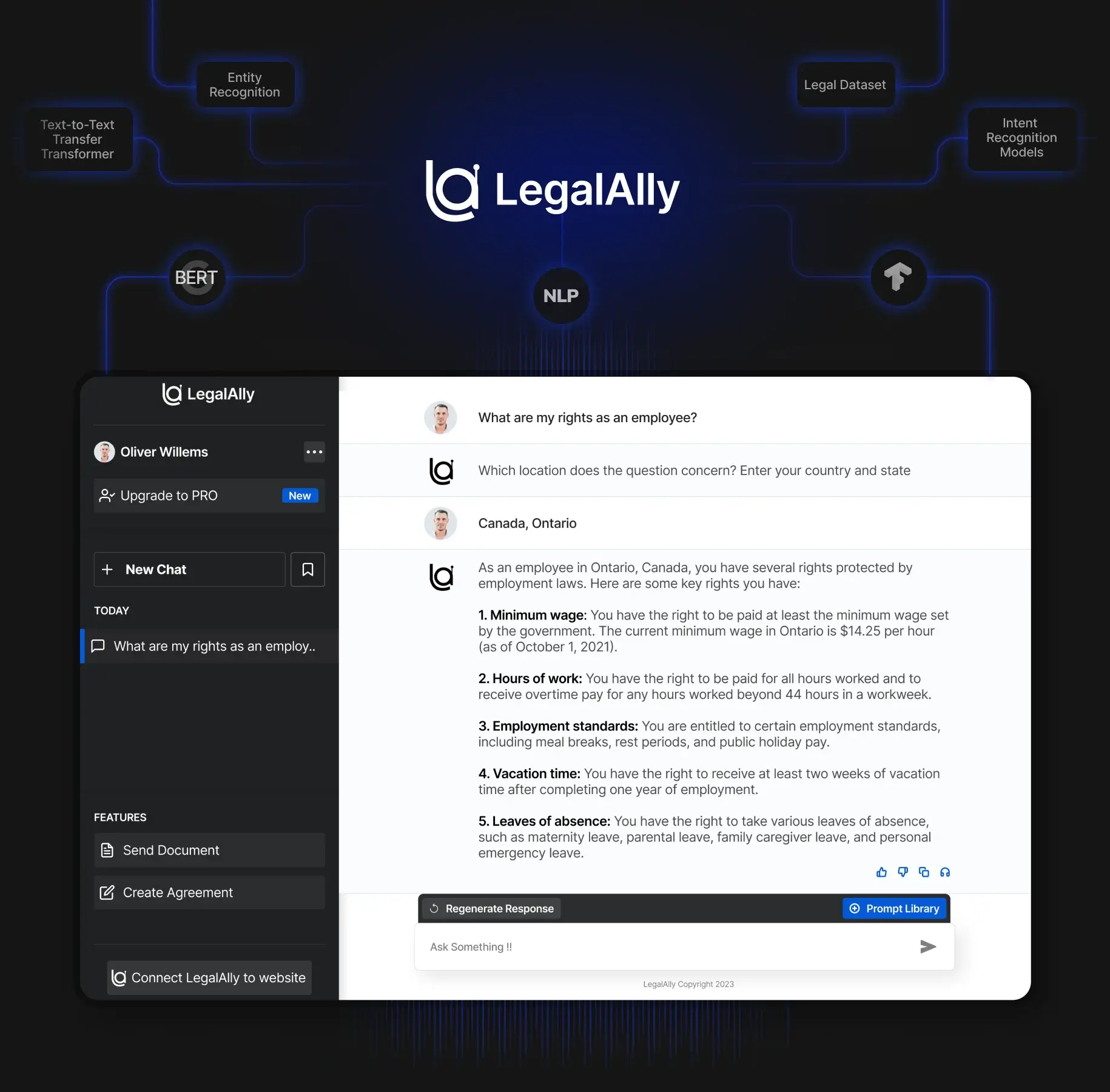

Enhancing Fintech Chat Platforms: Sentiment Analysis Algorithms Boost Customer Interaction

Our Collaboration Partners

Our proud clients

PROCESS

Our End-to-End Process for Fintech AI Development

Our trusted and well-established process ensures a smooth transition to AI, minimizing disruptions while maximizing outcomes.

Intelligent Need Analysis

Your fintech journey with us starts with a precise AI-assisted evaluation of your existing systems and challenges. Leveraging machine learning algorithms, our expert analysts probe your current bottlenecks to offer tailored technological solutions that drive fast and impactful resolutions. Outcome: Customized software requirements, a well-structured project plan, and a strategic roadmap.

AI-Infused Workshops & Preparation

To align your business objectives with our expertise, we organize AI-integrated workshops. Whether your focus is on UI/UX, technical specifications, or strategic orientation, our specialized teams employ AI tools for predictive analysis to foresee potential roadblocks. The outcome is a comprehensive understanding of your needs—translating into critical project documentation, refined wireframes, and compiled development prerequisites.

Adaptive Design & Development

Depending on your chosen solution, we employ AI algorithms to optimize backend architecture, design paradigms, and development speed. With adaptive learning models, we ensure the product evolves in real-time, making the development phase as agile as it is efficient.

Robust Testing

Once development is done, we deploy AI-powered testing mechanisms—both manual and automated—to rigorously evaluate the software’s resilience and performance. Tools like SonarQube are deployed alongside machine learning algorithms for code review, ensuring that the quality metrics align with predetermined KPIs established early in the project lifecycle.

Intelligent Deployment

Final deployment isn’t just a client-side task; it’s a partnership. We employ AI analytics to audit your operational environment, identifying any gaps or technical insufficiencies that could impede deployment. You receive a proactive list of recommendations to address these issues, ensuring a seamless launch.

Deployment and Ongoing Support

Once we’re confident that the AI models meet or exceed industry standards, we integrate them fully into your healthcare environment. But our relationship doesn’t end at deployment. We offer ongoing support and maintenance, continually updating the AI models to adapt to new data and healthcare practices.

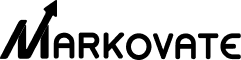

Healthcare

We harness the power of AI in healthcare to develop solutions that deliver precise diagnostics, tailored treatment plans, and efficient patient management. Our AI-driven technology accelerates drug discovery, offers predictive analytics for patient care, and streamlines administrative tasks, empowering healthcare providers to deliver the best possible care.

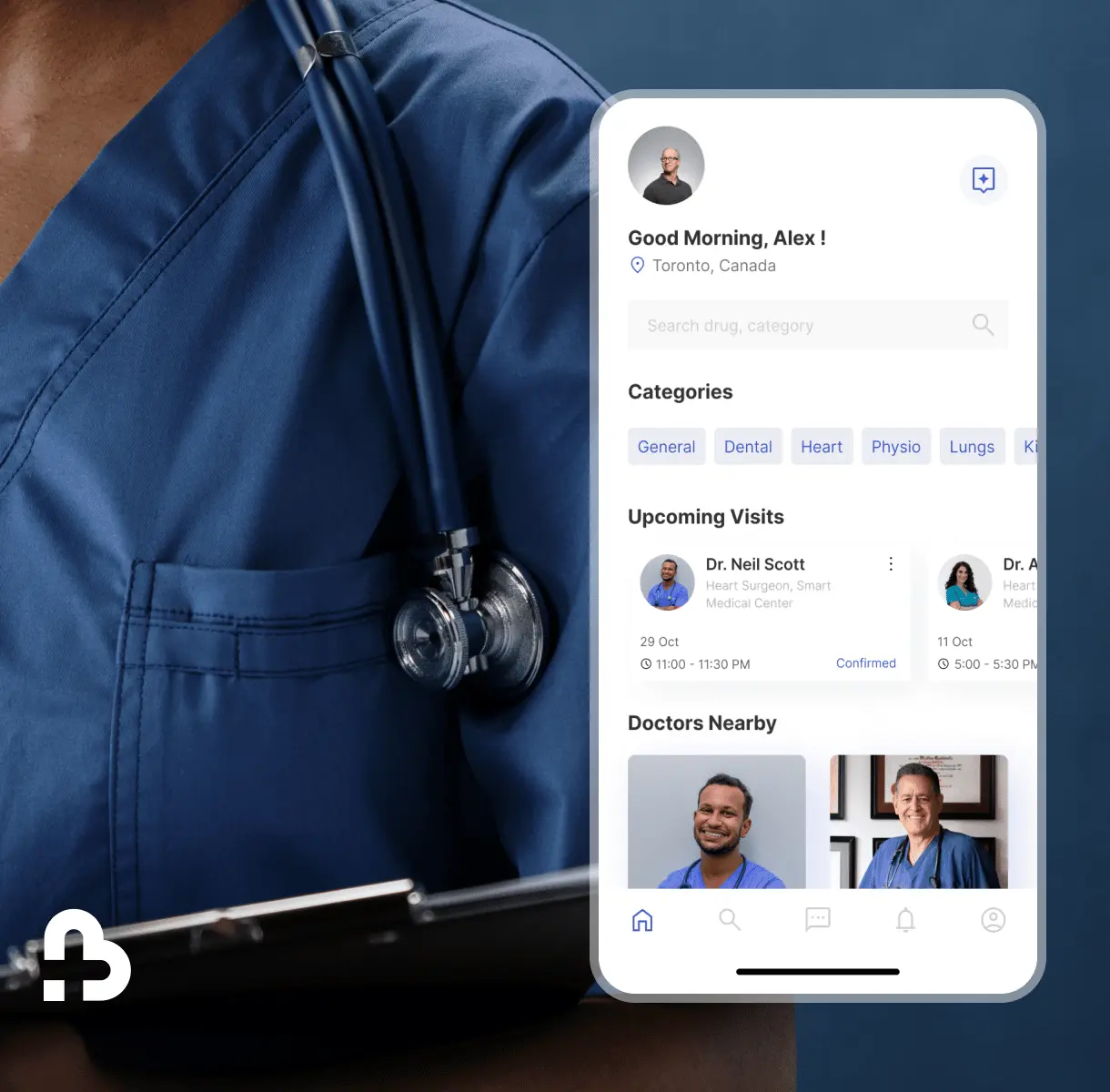

Retail

We develop solutions that redefine retail by harnessing AI for personalized shopping experiences, optimized inventory management, and predictive demand forecasting. Our AI-powered recommendations and virtual try-on experiences enhance customer engagement, transforming both online and offline retail operations.

INDUSTRIES

Developing smart solutions for every industry

Healthcare

AI in healthcare delivers precise diagnostics, tailored treatment plans, and efficient patient management. It accelerates drug discovery, offers predictive analytics for patient care, and streamlines administrative tasks, empowering healthcare providers.

“Our business operations have undergone a remarkable transformation with Markovate’s voice ordering system. Through seamless integration with our POS system and the utilization of cutting-edge technologies such as NLP and cloud infrastructure, efficiency has soared while delivering an intuitive ordering experience. I wholeheartedly endorse Markovate’s solution for businesses aiming to elevate their POS capabilities.” – Saskia Riverstone, Founder, SaaSure Solutions

Retail

We develop solutions that redefine retail by harnessing AI for personalized shopping experiences, optimized inventory management, and predictive demand forecasting. Our AI-powered recommendations and virtual try-on experiences enhance customer engagement, transforming both online and offline retail operations.

“Markovate’s use of OpenAI Pinecone and LLama has transformed our supply chain logistics and sales predictions while streamlining marketing content creation. Their report summarization technology simplifies data analysis, and decision-making. They’ve been pivotal in our digital transformation.” – Sara Al Nahyan, CTO, PacProfs Inc.

SaaS

In the SaaS industry, AI revolutionizes user experience by tailoring interfaces through behavior analysis, automating customer service, and fortifying cybersecurity. Leverage scalable, intelligent AI solutions that redefine SaaS.

“Working with Markovate has transformed our vendor management system. Their AI-powered solution has made our processes smoother and more efficient, thanks to their expertise in image classification and NLP. The personalized approach and innovative chatbot have empowered our team to make faster, more informed decisions. Markovate is more than just a technology provider; they are trusted advisors driving our operational excellence.” – Chris Cook, CEO, NVMS

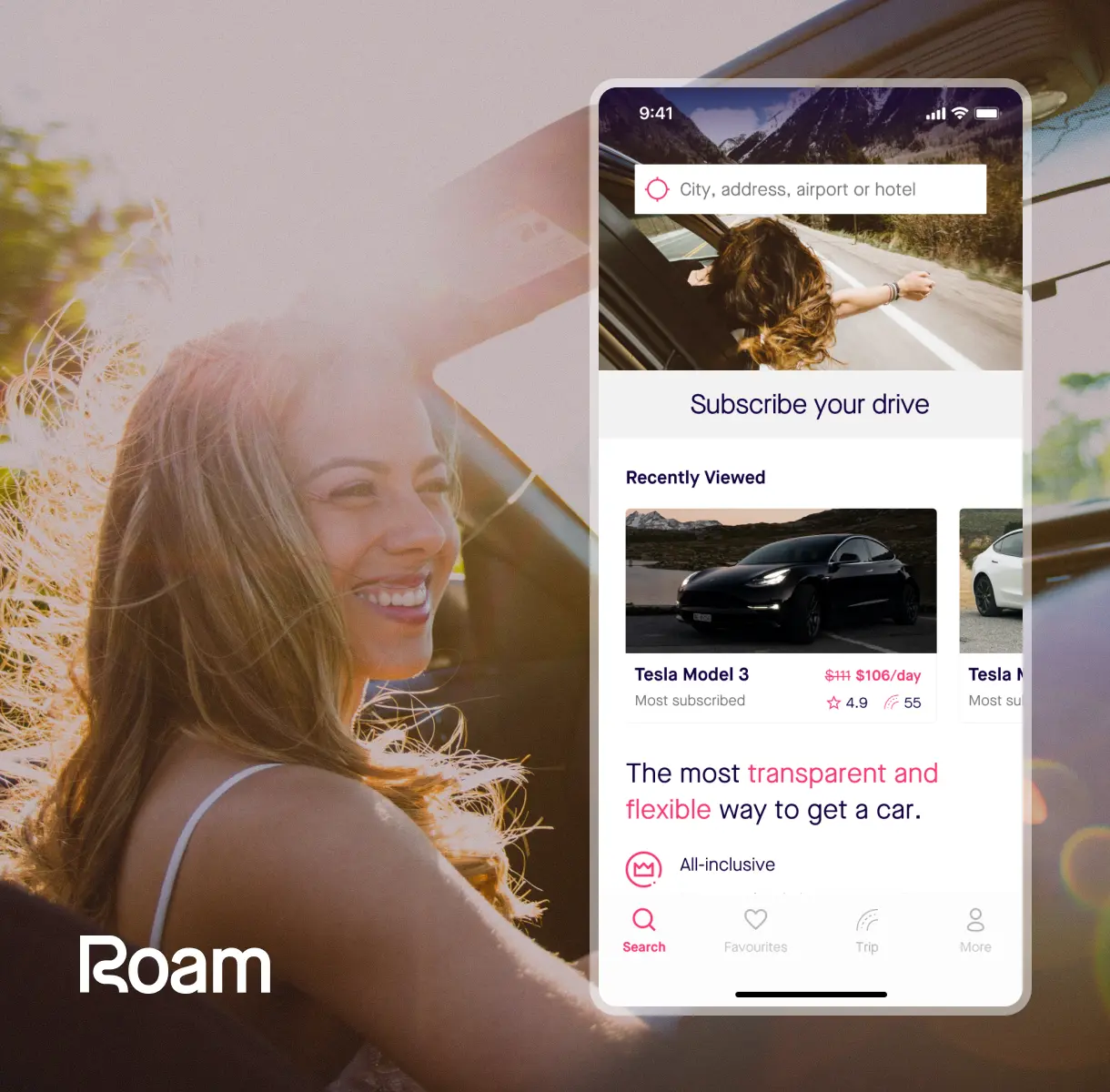

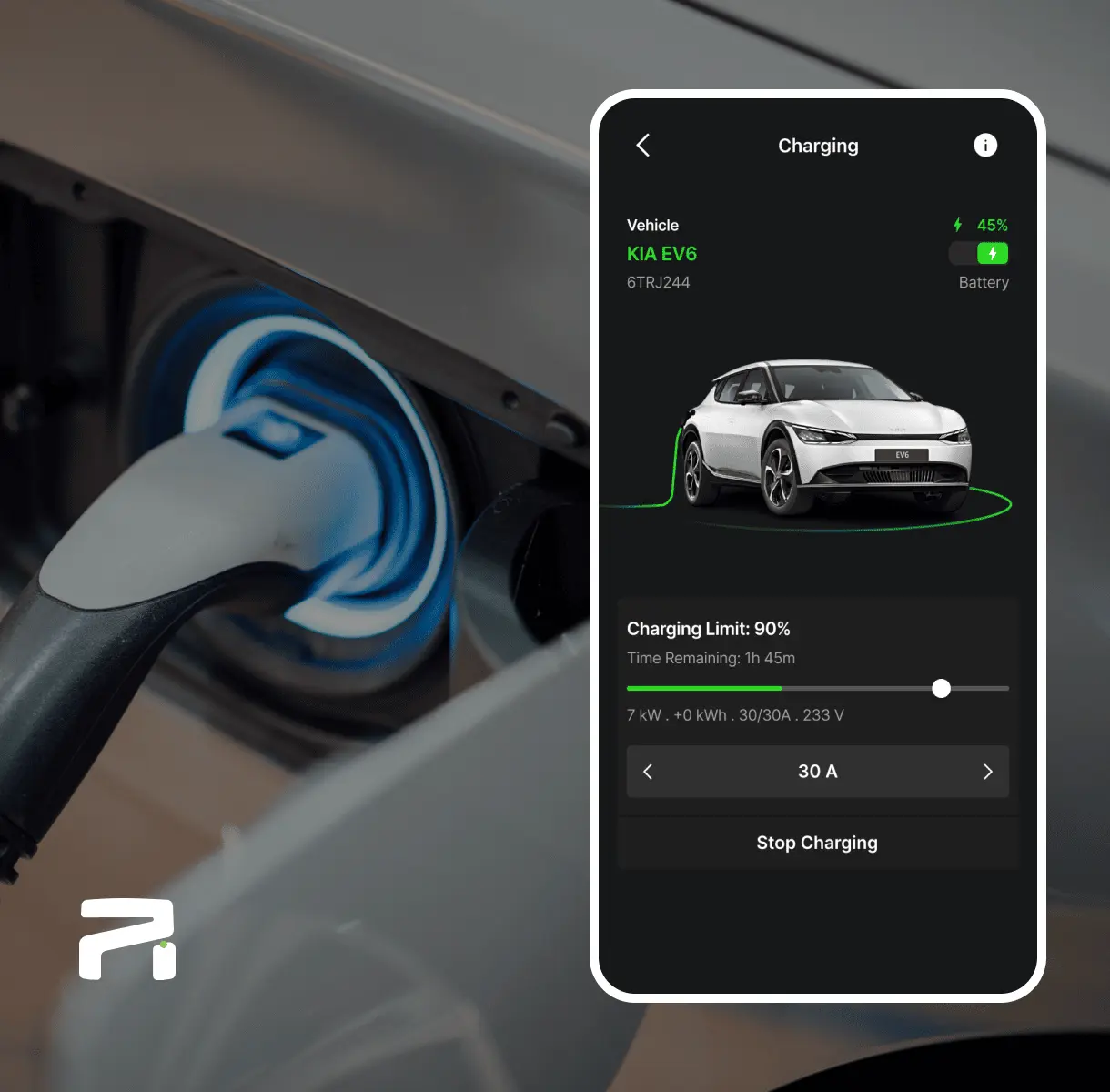

Travel

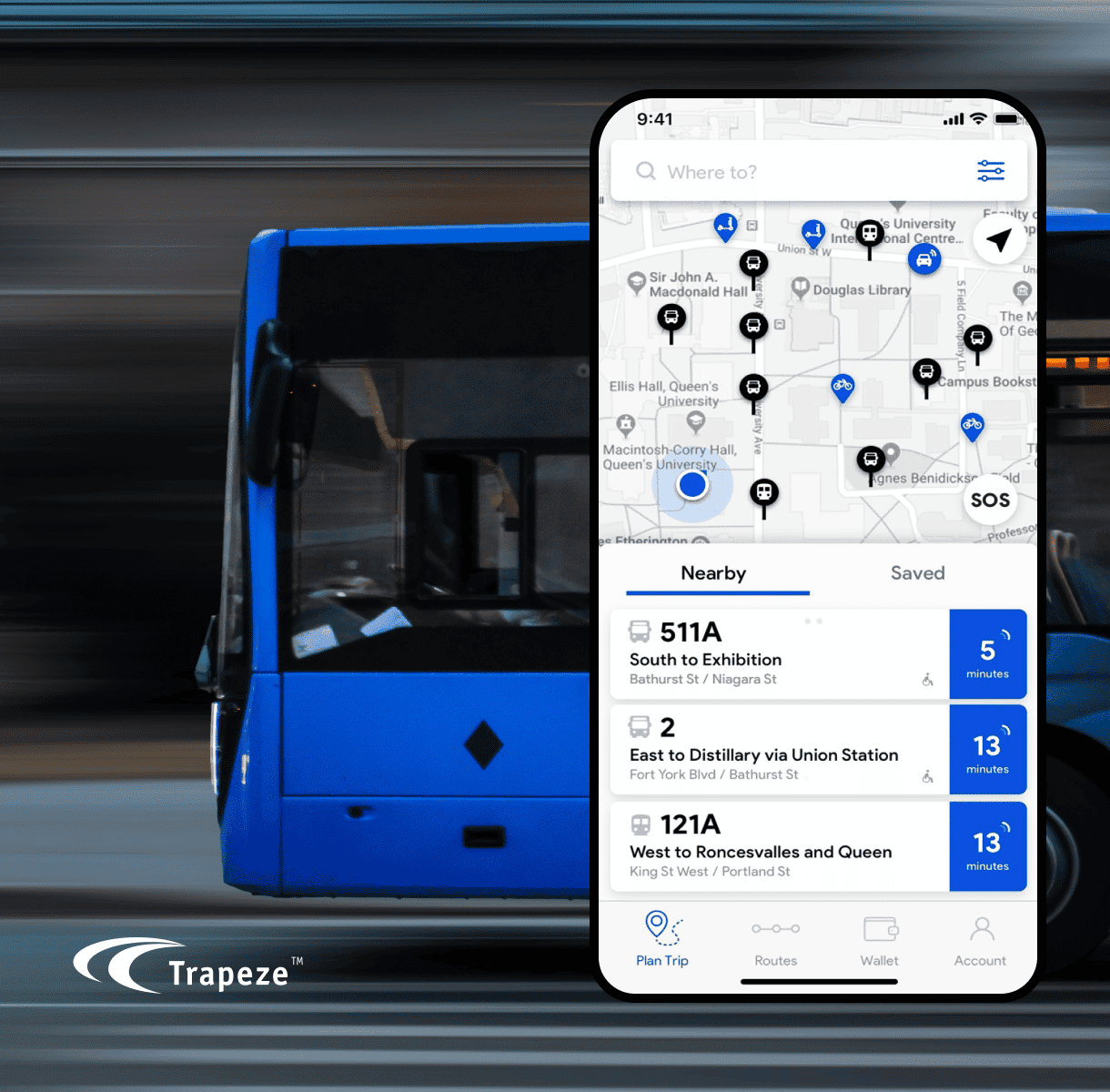

Elevate travel experiences with AI’s personalized recommendations, dynamic pricing & efficient booking systems. Enhance customer service through interactive chatbots & ensure fleet reliability with predictive maintenance.

“Markovate makes AI development clear and transparent. With active communication and optimal solutions, they alleviated our development concerns. Highly recommended for seamless product development partnerships.” – Garrett Vandendries, Director & PMO, Trapeze

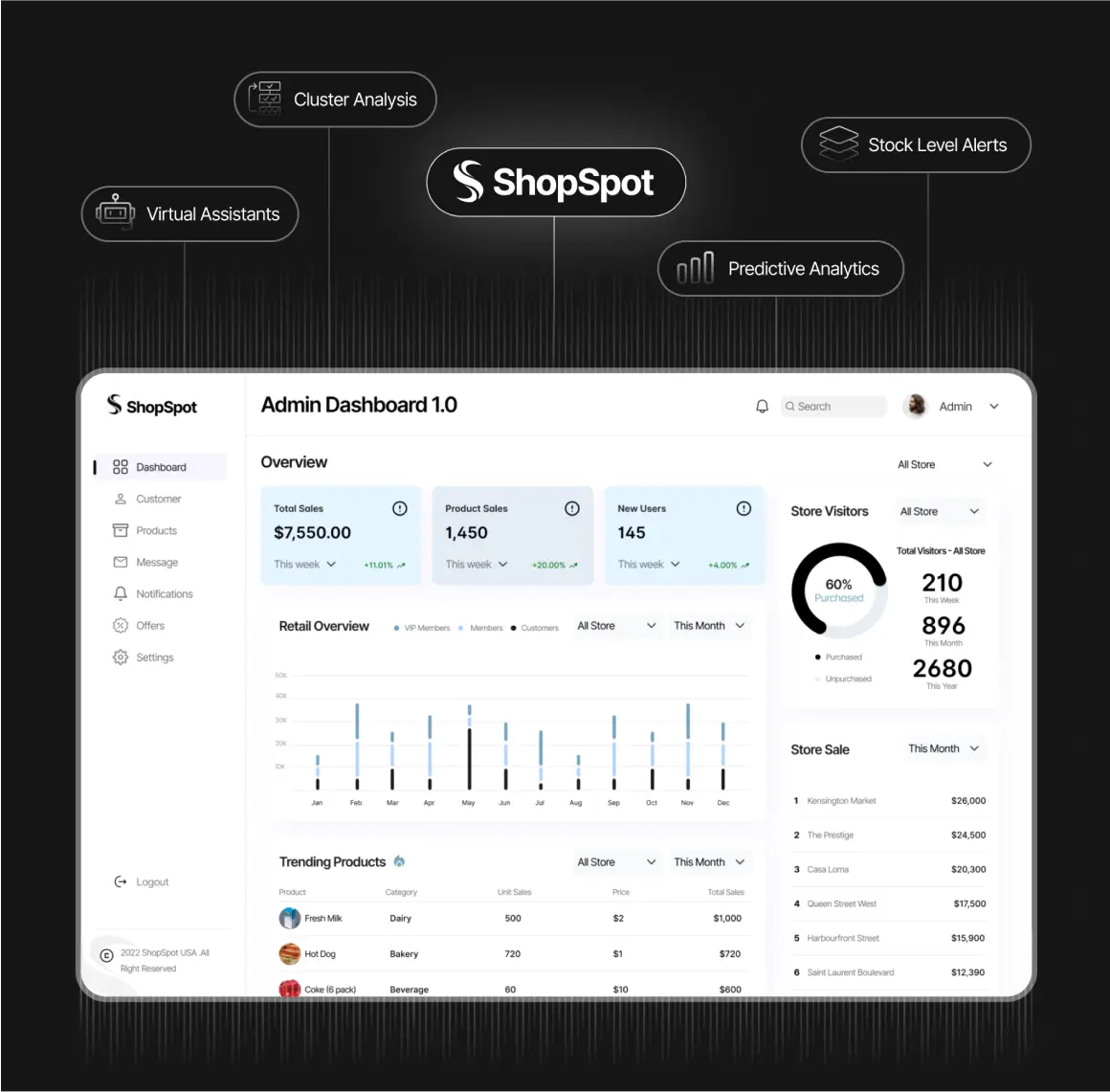

Fitness

Experience personalized workout and nutrition plans driven by AI’s data insights. Achieve fitness goals with virtual coaching and interactive apps, while AI aids in managing gym operations and retaining clients.

“Markovate has helped us build multiple products in the past. We definitely recommend them to anyone looking for product development.” – John D, CEO, Aisle24

FAQ’s

Fintech AI Development

What Specific AI Features Can I Expect in Your Fintech Solutions?

Our AI in Fintech solutions offer real-time credit scoring, fraud detection, and personalized customer engagement, all backed by AI algorithms optimized for the BFSI sector.

Is My Data Secure with AI-Enhanced Fintech Apps?

Absolutely. Our AI algorithms adhere to the highest data encryption and security compliance standards to ensure your financial information is safe and secure.

How Does AI Improve Efficiency in Financial Operations?

AI streamlines complex tasks, automates manual processes, and provides data-driven insights, allowing quicker decision-making and enhanced operational efficiency.

Is AI Integration Complex? What's the Transition Period?

Our team simplifies AI integration for a seamless transition. Usually, it takes 6-8 weeks to implement and test all AI functionalities fully.

How Do I Know if AI-Based Fintech Solutions Are Right for My Business?

Our AI specialists offer a comprehensive consultation to assess your needs and challenges, ensuring our AI-powered solutions align with your business objectives.