Banking and finance have not been exempt from the game-changing effects of artificial intelligence or just AI. It is similar to having an extremely clever assistant who anticipates clients’ needs. Do you remember when there were lengthy lineups at the bank? That has changed because AI in banking has improved convenience and responsiveness to user demands.

Fact Check: AI in Banking

Banks are already using AI in their services and applications to become more technologically sophisticated and genuinely customer-friendly. It is about improving efficiency, not just for the bank but also for clients like us.

However, AI not only makes life simpler for clients, but it also benefits banks. AI in banking is the greatest friend for boosting productivity. It helps to make difficult choices based on data and even recognize fraud within seconds. It is like having a 24/7 financial investigator!

How widely this is understood is what is truly amazing. Indeed, according to Business Insider research, approximately 80% of banks know the benefits of AI in banking. The possibility that AI would have a stunning $1 trillion impact on banking is suggested in a McKinsey analysis, which heightens the anticipation. That represents a significant shift rather than merely alteration.

The next time you are completing a financial transaction quickly on your phone, keep in mind that a lot of smart technology is at work, making banking not only something we have to do but also something simple, secure, and effective. AI in banking is paving the way for a bright new era in finance.

The data illustrates an emerging trend in the banking and financial sector, where artificial intelligence (AI) is quickly used to improve performance, customer service, and operational efficiency while lowering costs.

In this blog, we will delve into how this ground-breaking AI technology is revolutionizing how clients engage with financial institutions in the next piece as we examine the key applications of AI in banking and finance.

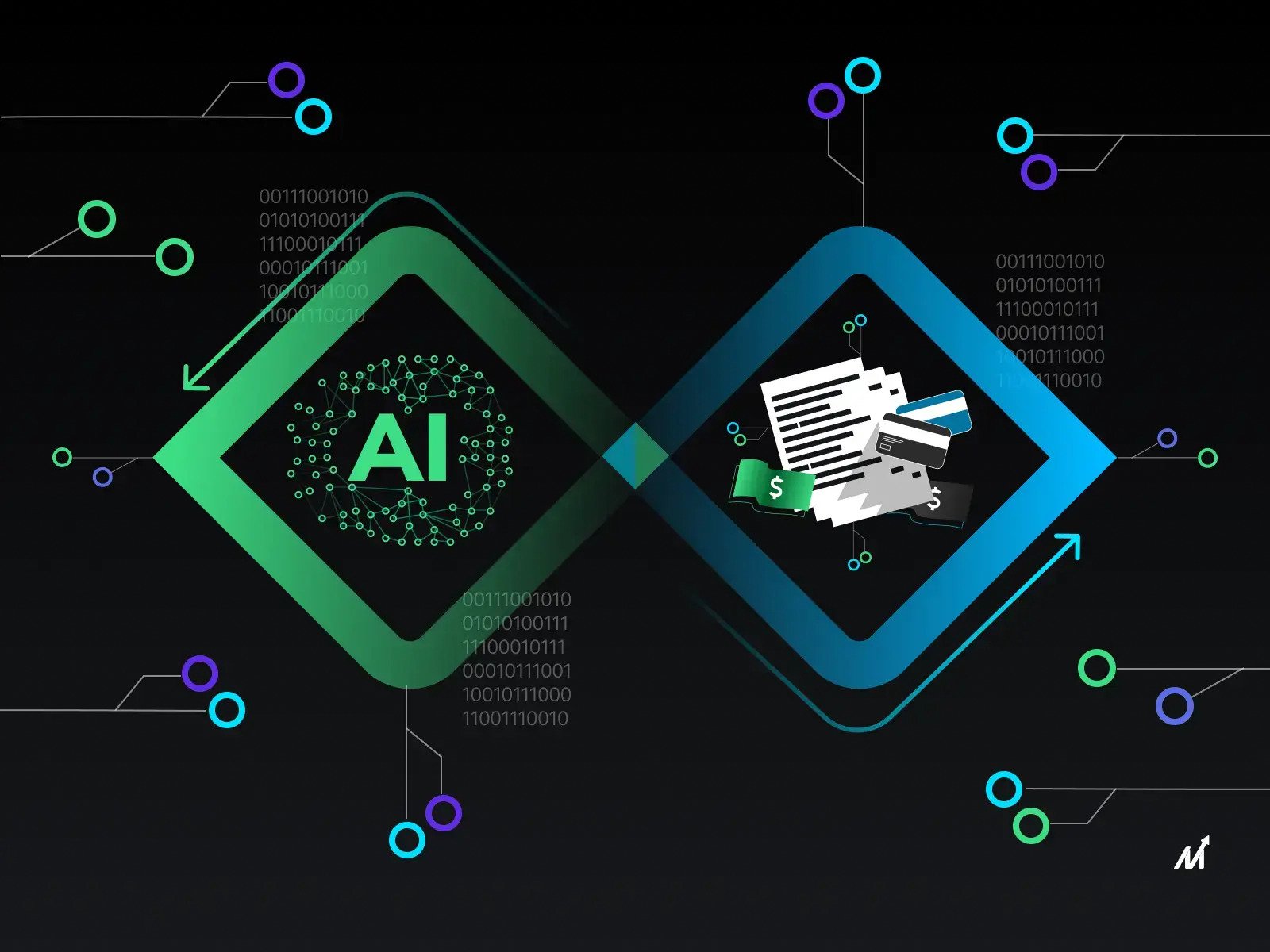

How is AI in Banking Transforming the Financial World?

Artificial intelligence (AI) is no longer trendy in today’s fast-paced digital world. The banking and finance industries are at the forefront of how it is altering several businesses. A closer look at how AI in banking is causing a stir is provided here:

1. Increasing Security and Combating Fraud

Banks are feeling the pressure regarding fraud and cybersecurity as the number of digital transactions increases like never before. But here is when AI in baking comes into play. Banks can get an advantage by using certain innovative algorithms and machine learning. This has been accomplished by Danske Bank in Denmark, which has reduced false alarms by half and cut down on fraud detection.

2. Chatbots: The Future of Customer Service

Nobody anticipated how useful chatbots could be because of AI in banking. Chatbots are becoming experts in customer service because of AI, which allows them to learn from every contact. Erica, the virtual assistant from Bank of America, is a prime example of a bot that is available to users 24 hours a day, 7 days a week, and can handle everything from security updates to debt counseling.

3. A New Perspective on Loan and Credit Approvals

The conventional methods of evaluating credit and loans have seen better days. Thanks to AI-driven algorithms, banks may now assess your creditworthiness more intelligently by concentrating on trends and behaviors. It is a game-changer, improving the accuracy and fairness of lending, especially for people with a poor credit history.

4. Gaining Control of Market Trends

Artificial intelligence (AI) is similar to having a crystal ball when identifying market trends and investing possibilities. It directs financial decisions with genuine intelligence by sifting through mountains of data and forecasting future trends. What an advantage in the market!

5. Data Handling, Boosted

It is difficult to deal with piles of transaction data, but AI makes it simple. AI in banking boosts accuracy and speed that are key to improving every aspect of the banking experience, from fraud detection to credit decisions.

6. Customer Experience that Wows

Customers expect interactions to be pleasant and seamless, and AI in banking makes that possible. The main goal is to make things easier and more enjoyable, from shortening the KYC process’s painful steps to accelerating loan approvals.

7. Reimagining Risk Management

Analytics from AI in banking serve as a safety net in a world full of unforeseen events like political upheavals or natural calamities. It offers information that enables banks to make informed choices quickly.

8. Compliance? No Stress!

Banking laws might be confusing, but AI’s NLP and deep learning are like having a tour guide. Making judgments and comprehending new compliance standards has become much simpler.

9. Predictive Analytics: A Goldmine for Sales

Opportunities for sales and cross-selling are expanding like never before because of AI’s capacity to uncover hidden patterns and insights in data. It is an innovative and fun approach to increasing money.

10. Automation That Functions Magically

Robotic process automation (RPA) aims to accomplish more tasks quickly. Major organizations like JPMorgan Chase are using it to speed up transactions and simplify data extraction.

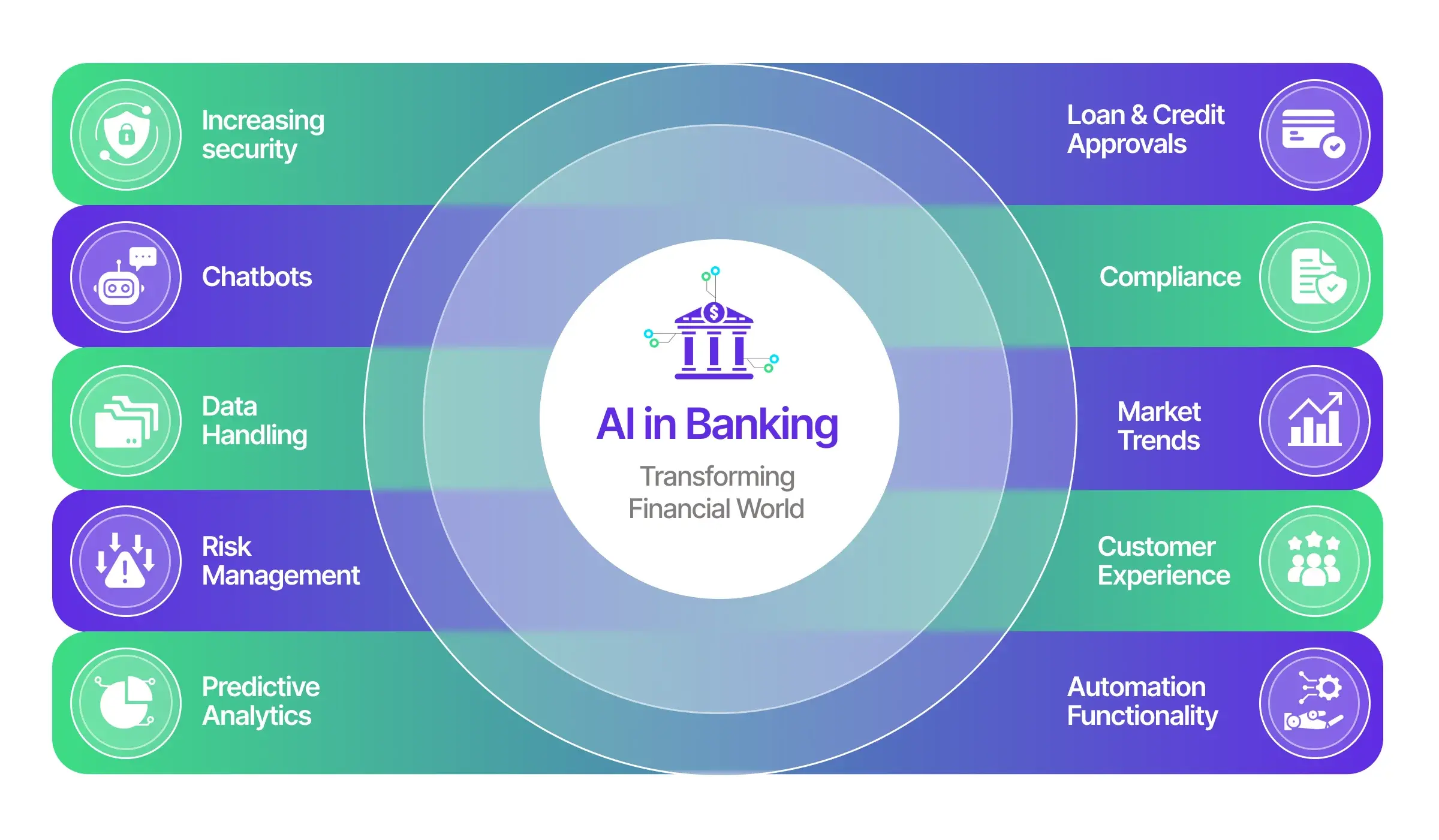

Benefits of Adopting AI in Banking

1. Taking Client Conversations to the Next Level with NLP and Conversational AI

Banking isn’t what it used to be. With tools like Natural Language Processing (NLP) and machine learning, banks chat with customers like never before. It’s all about providing quick and precise answers anytime you need them. Need to check your balance or make a payment? Just ask, and it’s done.

2. Taming the Paperwork Beast: OCR, Classification, and Extraction

If you’ve ever been drowned in paperwork, you know what banks deal with every day. However, thanks to AI in banking, that mountain of documents — from loan applications to invoices — is now a manageable molehill. OCR technology turns those stacks of paper into digital files, and automatic classification tools sort out the important details.

3. Keeping Things on the Straight and Narrow: Improved Compliance and Oversight

Banking laws are no joke, and the cost of slipping up can be steep. AI in banking steps in here, making sure everything aligns with regulations like anti-money laundering rules. If something looks off, it catches it early, letting banks fix issues before they become headaches.

4. Decision-Making Made Easy in Underwriting and Credit Analysis

When it comes to loans, making the right call is crucial. AI in banking takes the guesswork out of this, analyzing everything from credit scores to job history. It’s about making lending quicker, more accurate, and less risky. And it frees the human staff to do what they do best: connect with people.

5. Predicting Problems Before They Happen: Managing STP Exceptions and Work Drivers

In banking, small mistakes can lead to big problems. Straight-Through Processing (STP) automates transactions, but exceptions happen. That’s where AI-powered predictive analytics come in. Spotting potential errors early allows banks to fix things before they go wrong, keeping everything running smoothly.

6. Detecting Fraud and Other Bad Stuff: AI in Action

Nobody likes surprises, especially not the bad kind. AI in banking helps to avoid fraudulent activities by picking out unusual patterns and activities. Moreover, it’s like having a virtual security guard who never sleeps, always keeping an eye on things to make banking safer for everyone.

7. Getting Personal: Improve Customer Experience with Tailored Services

We all like to feel special, right? Indeed, AI in banking helps to provide services that feel like they were made just for you. By understanding your habits and needs, banks can offer you the right products, from investments to insurance. It’s about making banking feel like a friendly conversation rather than a sales pitch.

Bringing a Human Touch to Banking with AI

With all this talk of AI in banking, you might think we’re heading into a robotic future, but it’s quite the opposite. Imagine walking into a bank and being greeted by a chatbot that knows you by name and is ready to help. And the best part? You can do your banking anytime, anywhere. It’s not about machines taking over but using them to enhance human connections. In short. AI in banking means less time on hold and more time for what matters: personalized service and a touch of excitement in your everyday banking.

So there you have it. Banking might not be the most thrilling topic, but throw AI in banking into the mix, and it’s a whole new game. Whether you’re tech-savvy or just looking for better service, the fusion of AI in banking promises a world of benefits. Why settle for ordinary when you can “AI in Banking”?

Challenges of AI in Banking:

Navigating the challenges in Incorporating Machine Learning and AI in the banking and Financial industry as a whole.

Modern technology adoption in the banking industry, including Artificial Intelligence (AI), is a challenging process with wide-ranging effects. In particular, financial institutions must address various concerns, from maintaining high security to controlling data quality. Let’s delve into these aspects:

1. Ensuring Robust Data Protection

Strong security measures are required for the banking sector due to the enormous volume of data it stores. Hence, selecting the perfect technology partner—someone knowledgeable in AI and banking—is the first step in the strategy. Subsequently, they must offer a range of security measures to guarantee customer data privacy.

2. Addressing the Issue of Data Integrity

For creating and implementing a whole AI-powered financial system, reliable and organized data is needed. Specifically, such information is necessary for algorithm training and validation to ensure the algorithms apply to real-world situations.

Additionally, AI models may behave unexpectedly if the data is unsuitable for machine analysis. As a result, financial institutions that want to implement AI in banking must adjust their data strategy to minimize any potential privacy and legal problems.

3. Navigating the Complexities of Explainability

Due to its ability to cut down on mistakes and save time, AI-driven solutions are increasingly used in banking decision-making. But biases from earlier instances of poor human judgment could be carried over into this technology. The bank’s reputation and operational stability are at risk when minor AI algorithmic faults quickly worsen.

To avoid such blunders, banks must offer adequate transparency about the reasoning underlying the judgments made by AI algorithms. Furthermore, a thorough understanding and confirmation of how the system arrives at conclusions is good practice and a necessary step in establishing confidence and preserving integrity in the industry.

AI in Banking Practices

1. Strategize Data Governance and Integrity

In the banking sector, data integrity is paramount. AI systems are as effective as the data they process. Hence, establishing robust data governance frameworks ensures the reliability and accuracy of data fed into AI systems. This involves regular auditing of data sources, implementing data quality controls, and ensuring compliance with regulatory standards.

2. Crafting Contextual AI Models for Effective AI in Banking

AI in banking should not just be about processing data but understanding the context behind it. This involves developing AI models that are tailored to understand the nuances of financial data, customer behavior, and market trends. Consequently, contextual AI can provide more nuanced insights and predictions, crucial for decision-making processes in banking.

3. Addressing Ethical Considerations in AI in Banking

Given the sensitive nature of financial data, ethical considerations in AI deployment are crucial. Moreover, this includes ensuring that AI systems are transparent, accountable, and free from biases. Additionally, developing ethical guidelines and regularly reviewing AI models for fairness and impartiality is essential.

4. Seamlessly Integrating AI in Banking with Existing IT Systems

Seamless integration of AI with the bank’s existing IT infrastructure is critical for its efficient functioning. In addition, this involves ensuring compatibility between different systems, smooth data flow, and minimal disruption to existing processes. AI systems should augment and enhance existing IT capabilities, not replace them.

5. Upskilling Staff for AI Readiness

AI transformation is not just a technological shift but also a cultural one. Therefore, training and upskilling the bank’s workforce to work alongside AI systems is vital. This involves not just technical training but also educating staff on how AI can aid their work and decision-making processes.

6. Leveraging AI in Banking for Enhanced Risk Management

AI can play a crucial role in identifying and managing risks in banking. By analyzing vast datasets, AI can detect patterns indicative of fraud, credit risk, and operational risks, much more efficiently than traditional systems. Developing AI models specifically for risk assessment and management can significantly enhance the bank’s ability to preempt and mitigate risks.

-

Personalization of Customer Services

AI can be instrumental in delivering personalized banking experiences to customers. Specifically, by analyzing customer data, AI can offer tailored financial advice, personalized product recommendations, and customized service experiences. This not only improves customer satisfaction but also fosters customer loyalty and retention.

AI in Banking in a Snapshot

|

AI Technology |

Applications in Banking |

Benefits |

Limitations |

Examples of Usage |

|

Natural Language Processing (NLP) |

Customer Support Chatbots, Sentiment Analysis |

Enhanced Customer Interaction, Insight into Customer Preferences |

Language Complexity, Sarcasm Interpretation |

Wells Fargo’s AI chatbot |

|

Machine Learning (ML) |

Credit Risk Assessment, Fraud Detection |

Real-time Analysis, Accuracy, Personalization |

Data Quality Dependence, Complexity in Implementation |

JPMorgan’s COIN for legal document review |

|

Robotic Process Automation (RPA) |

Account Management, Transaction Processing |

Efficiency, Error Reduction, Cost Saving |

Limited to Rule-based Tasks, Implementation Challenges |

Deutsche Bank’s use of RPA in operations |

|

Computer Vision |

Check Scanning, Identity Verification |

Speed, Accuracy, Convenience |

Technology Maturity, Error in Complex Scenarios |

HSBC’s use of facial recognition for account opening |

|

Reinforcement Learning |

Trading, Portfolio Optimization |

Continuous Learning, Maximizes Rewards |

Computationally Intensive, Requires Expert Tuning |

BNP Paribas’ AI-driven trading strategies |

What Drives the Necessity for the Banking Industry to Align with an AI-dominant environment?

The race to adopt an AI-first approach within the banking sector is not without its obstacles, but it’s a race that’s underway and motivated by valid concerns. Meanwhile, over time, the banking field has evolved from focusing on personnel to emphasizing customer satisfaction. Consequently, this evolution has necessitated a more comprehensive strategy to address the desires and anticipations of clients.

In putting the customer at the core, banks are now considering the means to enhance their service quality. As a result, in today’s world, clients foresee that banks will consistently be accessible to them, meaning round-the-clock availability, all week long, and they want their banks to achieve this on a grand scale. Consequently, AI in banking presents the opportunity to make this a reality.

However, before they can meet these client demands, banks must overcome many internal barriers, such as outdated infrastructures, isolated data repositories, issues related to asset integrity, and restricted funding. Given that these obstacles can impede the rapid adjustments needed to satisfy customer needs, it’s hardly surprising that many banks view this.

AI in banking is a crucial instrument to facilitate these transformations. Yet, the question still lingers: how can this be achieved?

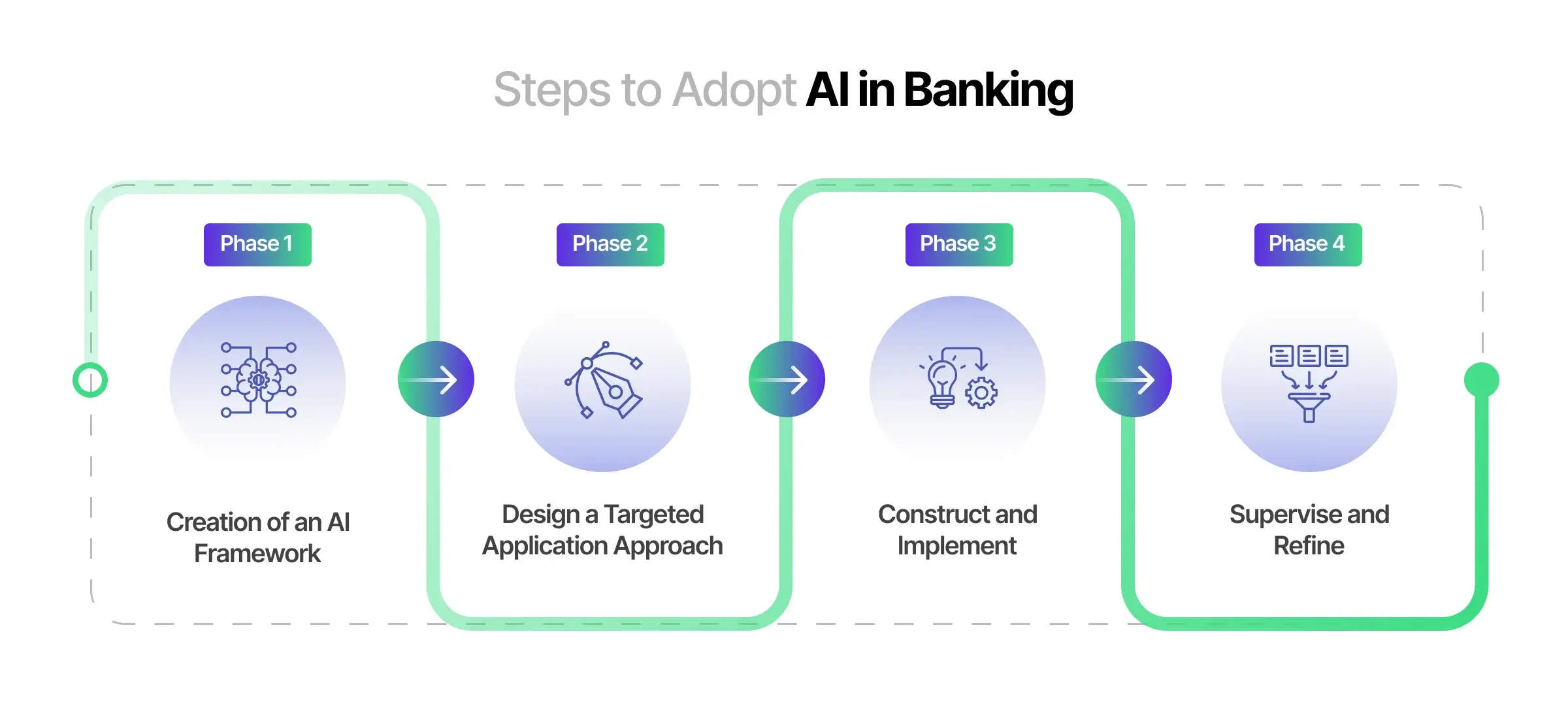

Steps to Adopt AI in Banking

We’ve already examined the ways AI in banking is applied. In this part, we’ll explore a set of actions financial institutions can embrace to fully integrate AI, focusing on four key considerations: human resources, regulatory compliance, workflow, and technological infrastructure.

Phase 1: Creation of an AI Framework

Embarking on AI in banking deployment begins with crafting a comprehensive AI vision per the organization’s mission and ethical principles.

It’s vital to perform an in-house assessment to pinpoint opportunities where AI in banking can address shortcomings in human talent or operational processes. Furthermore, ensuring alignment with both local regulations and global industry norms is paramount.

Concluding this phase requires fine-tuning internal protocols regarding skill development, data management, system architecture, and algorithmic processes. Additionally, this helps establish clear pathways for AI incorporation across various banking functions.

Phase 2: Design a Targeted Application Approach

This phase calls for recognizing the most beneficial AI in banking applications corresponding to the bank’s existing workflows and aims.

An evaluation must be conducted to determine the level of integration needed for AI within existing or restructured operations.

Upon surfacing viable AI applications, quality assurance professionals must assess feasibility, identifying any hindrances to implementation. Consequently, the final selection must revolve around practicality.

Concluding this stage involves pinpointing the necessary skill sets, such as algorithm developers or data scientists. Partnerships with tech firms or external hiring may be required if such expertise is unavailable internally.

Phase 3: Construct and Implement

Banks must go to implementation after the design phase. Initial prototype development aids in understanding potential technological constraints. Relevant and reliable data is crucial for prototype testing since the AI system uses it to learn and improve its knowledge.

The model should undergo rigorous testing once trained and adjusted to see how well it performs in actual situations.

Rolling out the improved model is the final phase. Meanwhile, as more manufacturing data comes in, improvements may be made continuously.

Phase 4: Supervise and Refine

Successful AI in banking implementation requires ongoing oversight and fine-tuning. Therefore, the entire performance of the AI system has to be evaluated regularly. Consequently, this helps to ensure excellent operational delivery and to reduce cybersecurity threats.

Certain actions must be followed to ensure the integrity and objectivity of the input, which is regularly provided to the AI model throughout the operational phase. This will help to create a model that is both balanced and efficient.

For a more detailed action plan, you can refer to AI consulting services.

Why Us? Markovate’s Strategic Approach to AI in Banking

With 60% of financial organizations currently using AI, the merger of AI and banking heralds a new era marked by a purposeful shift toward better automation. Indeed, this isn’t simply a fad; it’s evidence of AI’s inevitable involvement in revolutionizing the financial sector. The use of AI in banking is not only relevant but essential, with applications ranging from process optimization to improving consumer connection.

In this world of AI, Markovate shines like a beacon and is prepared to join you on your difficult but worthwhile trip. Moreover, our artificial intelligence development services and machine learning (ML) solutions aren’t just technical; they’re strategic tools to boost income, reduce waste, and strengthen risk management across various banking operations. With Markovate, it’s not only about technology; it’s about laying the groundwork for a banking industry with a brighter, more creative future.

(Loved this blog? Read about AI in Sports too)

Real-World Cases of AI in Banking

1. Embracing Innovation at Capital One, McLean, Virginia

Capital One isn’t just a traditional bank; it’s a trailblazer in integrating Artificial Intelligence. For example, in 2017, they introduced Eno, a virtual assistant capable of engaging with customers through various channels, including mobile apps, text, email, and desktop platforms. Furthermore, Eno doesn’t merely answer queries; it offers fraud alerts and assists with credit card payments, monitoring account standings, viewing credit availability, and inspecting transactions. Moreover, the most intriguing part? Eno talks just like we do, even with the ability to use emojis.

2. Kasisto’s Digital Revolution, New York, New York

The rise of digital-first banks has created a buzz in several regions globally, focusing on the U.K. Entering the U.S. market, Kasisto has become a prominent player in this wave. Kasisto empowers banks to create personalized chatbots and virtual assistants through its conversational AI platform known as KAI. Moreover, KAI isn’t just a chat tool. It has deep roots in AI reasoning and natural-language understanding and generation, enabling it to tackle complex financial inquiries. Consequently, renowned banks like Liv., DBS Bank, Standard Chartered Bank, and TD utilize KAI-driven bots to guide customers in intricate processes such as international transfers and credit card management, seamlessly connecting to human assistance.

3. Simudyne’s Impact on Investment Banking, Fully Remote Operation

Investment banking was one of the first sectors to feel the powerful influence of automation. Similarly, Simudyne, a technological force, harnesses the power of agent-based modeling and machine learning to conduct myriad market scenario analyses. Consequently, the platform, sophisticated in its capabilities, allows for comprehensive stress tests and market contagion examinations on a grand scale. The company’s CEO, Justin Lyon, revealed to the Financial Times how their system helps bankers identify rare but highly consequential risks. Consequently, by recognizing the potential, Barclays led a $6 million funding round for Simudyne in 2019.

4. FIS’s Pioneering Work, Location: Jacksonville, Florida

FIS is more than a financial service provider; it’s a technological innovator using C3 AI in its dedicated compliance hub to battle financial malfeasance. In addition, the machine learning-infused platform amalgamates and scrutinizes client data from various sources to fortify Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures. In addition, FIS’s credit analysis solution leverages machine learning to capture, digitize, and deliver instantaneous financial insights and deal-related data.

Future of AI in Banking

In today’s rapidly evolving digital landscape, nearly every sector races to adapt and integrate new technologies. Specifically, AI in banking is at the forefront of this transformation, facing a pressing issue: how to effectively serve a growing, increasingly tech-savvy customer base without ramping up operational costs.

Now, let’s face it—customers today aren’t just hoping for top-tier services; they’re flat-out expecting it. Whether it’s the ease of mobile payments or the assurance of secure transactions, the modern bank-goer wants it all. So how are banks keeping up? By borrowing tech advances from fields you might not expect, like retail and telecom. Consequently, these collaborations have led to perks like real-time money transfers and sophisticated mobile banking apps.

But these shiny new features don’t come without their own set of headaches. Increased connectivity means more potential for security risks. Imagine the nightmare of confidential data leaks or, worse yet, full-blown cyber-attacks that can decimate not just the bank’s finances but also customer trust.

So what’s the banking world’s ace in the hole? Artificial Intelligence, or as the pros call it, AI in banking. In fact, far from being just a buzzword, AI in banking offers real, tangible benefits that go beyond just crunching numbers or automating routine tasks. Specifically, we’re talking about employing machine learning and data analytics to understand what customers want and need genuinely. Moreover, these advanced systems can predict user behavior, allowing banks to offer personalized services that hit the mark every time.

And let’s not forget about security. AI algorithms can monitor transactions in real time, flagging suspicious activities quicker than any human could, thereby adding an extra layer of much-needed security.

FAQs

1. In What Ways Is AI Transforming Corporate Banking?

Navigating through the bustling corridors of corporate banking, AI emerges as an innovative partner. Moreover, it doesn’t merely automate mundane tasks; it reinvents customer engagement via intelligent chatbots, serves as a sentinel against fraud, hones investment strategies, and gazes into the crystal ball of market dynamics. This synergistic blend enables a banking experience that’s both efficient and more personal and tailor-made.

2. How is the Banking Landscape Being Reimagined Through AI Trends?

The embrace of AI in banking isn’t a fleeting fascination; it’s a transformative tide reshaping how financial institutions operate:

- Elevating Customer Conversations: Beyond chatbots, AI crafts a virtual concierge that personalizes interactions and understanding and addresses individual needs and queries.

- The Quiet Efficiency of RPA: Robotic Process Automation (RPA) isn’t about cold machines; it’s about warm efficiency that sweeps away routine tasks, allowing human minds more creative space.

- Guardian Against Fraud: AI’s vigilant eye sifts the subtleties in oceans of data, drawing out patterns that might evade the human gaze, acting as a bulwark against financial misconduct.

- Bespoke Banking Solutions: With AI at the helm, banking becomes an art where services are sculpted to fit the unique contours of each client’s financial life.

- The FinTech Frontier: In recognizing AI’s unparalleled merits, FinTech ventures delve into data’s depths, unearthing insights that guide market forecasts and risk assessments, sharpening the financial acumen.

3. Risk Management in Banking: How Does AI Fit Into the Puzzle?

AI’s role in banking risk management is a fascinating tapestry woven with technological finesse:

- The Data Detective: AI’s meticulous scrutiny uncloaks subtle trends and outliers that may herald impending risks, like Sherlock Holmes with a digital magnifying glass.

- Real-Time Vigilance: In the fast-paced world of digital banking, AI’s watchful eye ensures that no beat is missed, identifying and neutralizing threats with the agility of a financial guardian.

- Unmasking Fraud with Precision: Fraud doesn’t stand a chance against AI’s intelligent algorithms, which dissect behavior and transactions with surgical precision.

- Compliance as a Symphony: Far from a drudging task, AI turns compliance tracking into a simple task, aligning with regulatory nuances effortlessly.

- Predictive Wisdom: Predictive risk modeling is more than number-crunching; it’s AI’s way of painting a picture of future landscapes, offering invaluable insights into defaults and market tremors.