Imagine a world where financial institutions could predict and mitigate risks with pinpoint accuracy, much like a captain who can detect storm clouds on the horizon long before they become a threat. This once far-fetched dream is now becoming a reality, thanks to the transformative power of artificial intelligence (AI) in finance. But how exactly is AI reshaping risk management in the financial services industry? Let’s delve into the remarkable ways AI-driven risk management solutions are revolutionizing this critical field.

The Rise of AI in Financial Services

Financial services have always been a high-stakes game, where even a small misstep can result in significant financial losses. Traditional financial risk management tools, while effective to some extent, often struggle to keep up with the complexities and rapid pace of modern markets. This is where AI steps in, offering advanced risk management algorithms that can process vast amounts of data at unprecedented speeds, providing insights that were previously unattainable.

By harnessing the power of AI in risk management, financial institutions can now analyze market trends, identify potential threats, and make informed decisions with a level of precision that was unthinkable a few years ago. This not only enhances their ability to mitigate risks but also helps in optimizing their overall operational efficiency.

Predictive Analytics and Risk Mitigation

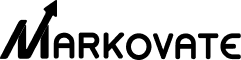

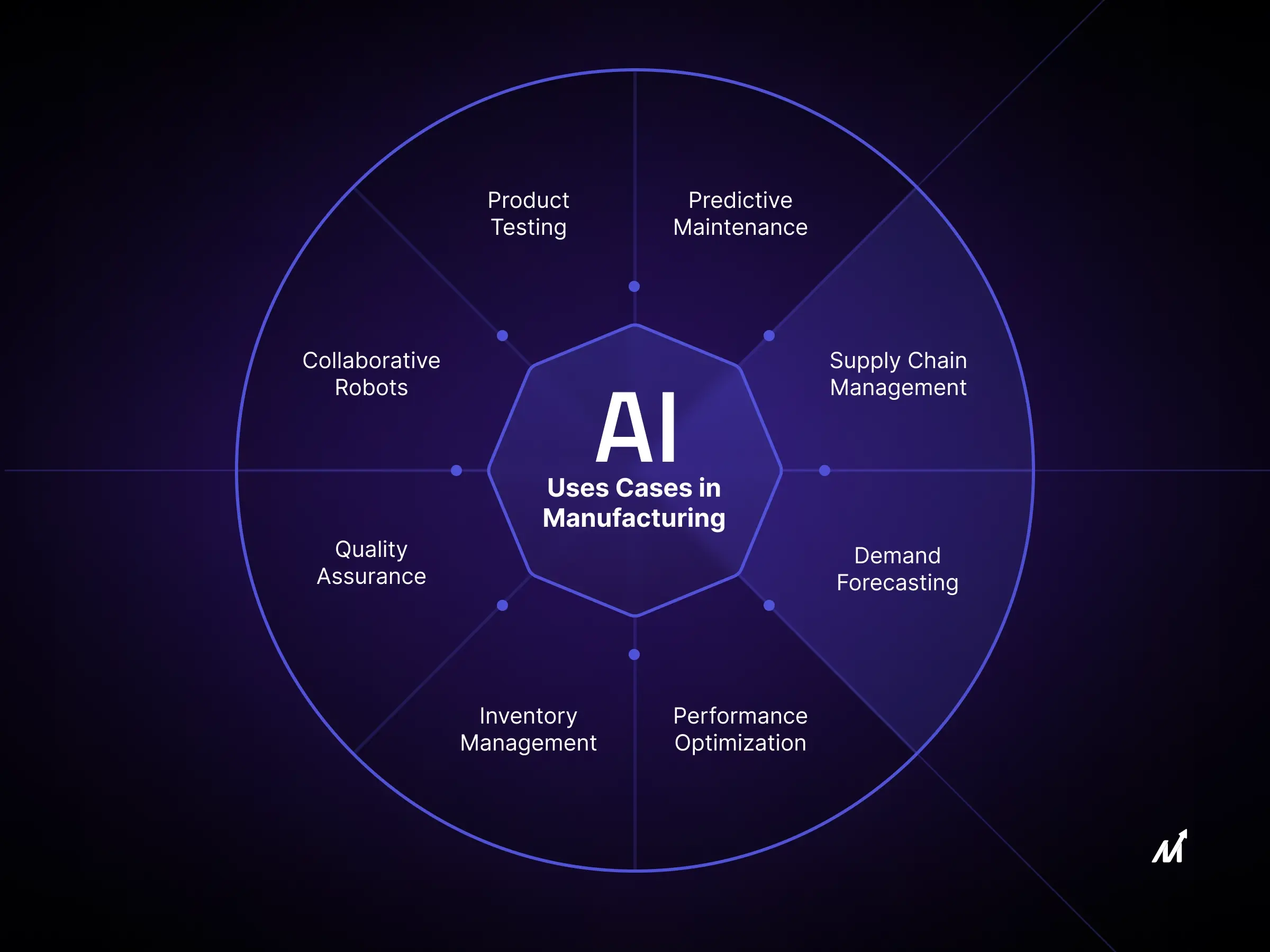

One of the most prominent applications of AI in financial services is predictive analytics. Through sophisticated machine learning algorithms, AI can analyze historical data, detect patterns, and predict future market behavior. For instance, AI-driven risk management solutions can foresee market downturns, enabling financial institutions to take preemptive measures to cushion the impact.

By utilizing advanced risk management algorithms, banks and financial institutions can identify and assess potential risks more accurately. This predictive capability is crucial in areas such as credit risk management, where assessing the likelihood of a borrower defaulting on a loan can determine the institution’s financial health.

Enhancing Fraud Detection and Prevention

Fraud is a persistent and costly challenge in the financial sector. Traditional fraud detection systems often rely on predefined rules and historical data, which can fall short in identifying new and evolving fraud tactics. AI, however, excels in recognizing subtle anomalies and patterns that human analysts might miss.

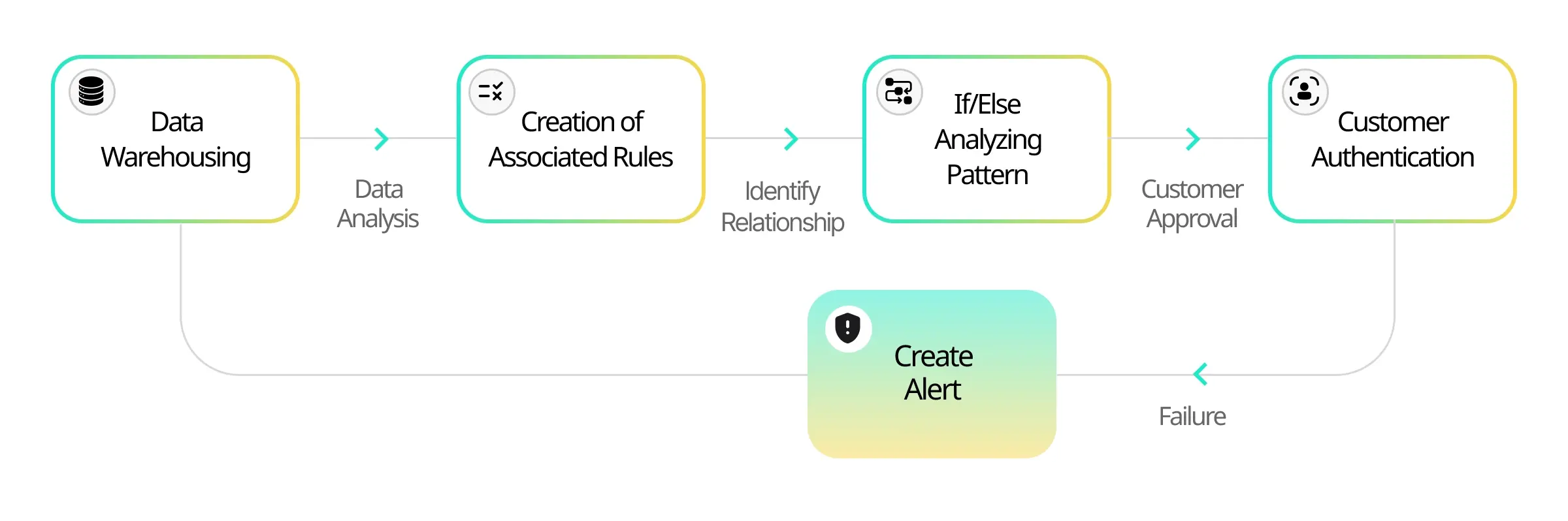

AI in risk management employs real-time data analysis and behavioral analytics to detect fraudulent activities as they occur. This immediate response is invaluable in minimizing financial losses and protecting customers’ sensitive information. Moreover, AI’s self-learning capabilities mean that it continuously updates its algorithms to stay ahead of emerging fraud techniques, making it an indispensable tool in the fight against financial crime.

Real-Time Risk Assessment and Decision Making

In the fast-paced world of finance, timeliness is everything. Delayed decisions can result in missed opportunities or escalating threats. AI-driven risk management solutions provide real-time risk assessment, empowering financial institutions to make swift, informed decisions.

For example, during periods of high market volatility, AI algorithms can instantly analyze current trends and offer actionable insights. This enables portfolio managers to rebalance investments, hedge against potential losses, and maximize returns with confidence. The ability to adapt and respond to real-time data is a game-changer, ensuring that financial institutions remain agile in a dynamic market environment.

Compliance and Regulatory Risk Management

Navigating the complex landscape of financial regulations is a daunting task for any financial institution. Therefore, non-compliance can lead to hefty fines, reputational damage, and operational disruptions. AI in financial services offers a robust solution to this challenge by automating compliance processes and ensuring adherence to regulatory standards.

AI-driven risk management solutions can monitor transactions, detect suspicious activities, and generate compliance reports with minimal human intervention. This not only reduces the burden on compliance teams but also minimizes the risk of human error, ensuring that financial institutions stay in line with ever-evolving regulations.

Improving Customer Experience and Trust

Beyond mitigating risks, AI in financial services also plays a pivotal role in enhancing customer experience. By leveraging AI technologies, financial institutions can offer personalized services, timely advice, and robust security measures that foster trust and loyalty among customers.

For instance, AI-powered chatbots can provide customers with instant support and tailored financial advice, while advanced fraud detection systems protect their accounts from unauthorized access. This combination of superior service and heightened security not only improves customer satisfaction but also strengthens the institution’s reputation in a competitive market.

Case Study: AI-Driven Risk Management at Work

To illustrate the real-world impact of AI in risk management, consider the example of a major US bank that integrated AI technologies into its risk management framework. By utilizing AI-driven risk management solutions, the bank was able to:

- Reduce credit risk by accurately assessing borrowers’ creditworthiness using predictive analytics.

- Enhance fraud detection, resulting in a significant decrease in fraudulent transactions.

- Streamline compliance processes, ensuring timely and accurate reporting to regulatory authorities.

- Improve portfolio management by providing real-time insights, leading to better investment decisions.

In this case, the successful implementation of AI not only improved the bank’s risk management capabilities but also contributed to increased operational efficiency and profitability.

The Future of AI in Risk Management

As AI technologies continue to evolve, their applications in financial risk management are expected to expand even further. Innovations such as natural language processing, sentiment analysis, and blockchain integration hold the potential to further enhance the accuracy and effectiveness of AI-driven risk management solutions.

Financial institutions that embrace these advancements will be better equipped to navigate the complexities of modern markets, safeguard their assets, and maintain a competitive edge. The future of financial risk management is undeniably intertwined with the progress of AI, promising a safer, more resilient financial landscape.

How Markovate can help with business by implementing AI in Risk Management

We specialize in integrating AI into risk management to fortify and enhance your business operations. AI solutions we develop can empower business tools with predictive analytics, real-time monitoring, and adaptive decision-making capabilities, ensuring a proactive stance on risk management and fostering operational resilience.

Our innovative methods enable clients to leverage advanced AI technologies, making their applications not only state-of-the-art but also secure and reliable.

We engineer AI-based financial risk assessment solutions for financial institutions. This tool utilizes predictive analytics to identify potential financial risks, allowing for proactive mitigation strategies that save time and resources while enhancing decision-making accuracy.

The AI team at Markovate recently implemented AI in the supply chain management system of a global retail giant. The client sought to improve efficiency and reduce disruptions, so we provided an AI-powered solution for real-time monitoring and anomaly detection. This system successfully minimized operational risks and significantly improved response times to potential supply chain issues.

Connect with our AI experts to help your business with risk management strategies with our advanced AI-enabled solutions.

Conclusion

Artificial intelligence in finance is not just a technological trend; it is a paradigm shift that is redefining the way financial institutions manage risk. By leveraging AI in risk management, financial institutions can harness the power of predictive analytics, real-time data processing, and advanced algorithms to mitigate risks, enhance security, and optimize operations.

As we move deeper into the digital era, the adoption of AI-driven risk management solutions will become increasingly crucial for financial institutions seeking to thrive in a rapidly changing environment. Consequently, with AI as a strategic ally, the financial services industry stands poised to achieve unprecedented levels of efficiency, security, and resilience.

Q1: How does AI-based predictive analytics work in risk management?

A3: AI-based predictive analytics involves analyzing historical data to identify patterns and predict future risk scenarios. This allows businesses to take proactive measures to mitigate risks before they occur. Our experts can show you how implementing predictive analytics can enhance your risk management strategy. Contact us for a demonstration.

Q2: What is the implementation process for Markovate’s AI solutions in my business?

A4: The implementation process involves a thorough assessment of your current risk management practices, customization of our AI solutions to fit your specific needs, and seamless integration with your existing systems. Our team provides continuous support to ensure successful deployment and optimal performance. Schedule a consultation to get started.

Q3: Can Markovate’s AI solutions help with regulatory compliance?

A6: Yes, our AI solutions can automate compliance monitoring and reporting, ensuring that your business adheres to relevant regulations and standards. This reduces the risk of non-compliance and associated penalties. Let us help you streamline your compliance processes with AI. Get in touch for more details.

Q4: What kind of support does Markovate offer after the AI solution is implemented?

A7: We offer comprehensive support, including continuous monitoring, regular updates, and dedicated customer service to address any issues or questions you may have. Our goal is to ensure that our AI solutions consistently deliver optimal performance for your business. Contact our support team anytime for assistance.

I’m Rajeev Sharma, Co-Founder and CEO of Markovate, an innovative digital product development firm with a focus on AI and Machine Learning. With over a decade in the field, I’ve led key projects for major players like AT&T and IBM, specializing in mobile app development, UX design, and end-to-end product creation. Armed with a Bachelor’s Degree in Computer Science and Scrum Alliance certifications, I continue to drive technological excellence in today’s fast-paced digital landscape.