PoW vs PoS: Introduction

The blockchain is secure via proof of work and proof of stake algorithms, allowing users to add new cryptocurrency transactions. Despite this, there are a few differences between them; therefore, knowledge of PoW vs PoS is essential.

Cryptocurrency is decentralized, and to make transactions transparent, they must first be computer-verified. Users are helped in performing secure transactions by proof of stake and proof of work since they make it difficult and expensive for fraudsters to succeed. Participants must demonstrate that they provided the blockchain with resources like electricity, processing power, or money.

The way the blockchain algorithm selects and qualifies users for contributing transactions to the blockchain is the primary difference between PoW vs PoS.

PoW vs PoS: Navigating Through Meaning

What Is Proof Of Work?

Powerful computers used by miners must solve complex puzzles in the proof of work consensus algorithm. Trial and error are used to resolve problems. The first miner to figure out the riddle or cryptographic equation has the privilege of adding new blocks to the blockchain for transactions. After a miner has confirmed the block, the digital currency is added to the blockchain. The miner is also compensated in cryptocurrencies.

A proof-of-work system requires powerful, rapid computers. The cryptocurrency network uses a lot of energy, so transaction times may become slower as it grows.

Because it would take a malicious actor controlling at least 51% of the network’s computing power to compromise the blockchain network, it is still secure. A fork in the blockchain happens when the community changes the protocol, and the chain splits into two new chains. The original’s history likewise shifts in a new direction to avoid duplicating transactions or spending. Miners can switch to the more recent split network or continue to maintain the original. That makes it significantly more difficult for a bad actor to control 51% or more as they would need to allocate processing resources to both sides of the fork and maintain both blockchains.

What Is Proof Of Stake?

Miners promise a digital currency investment before providing proof of stake for transactions. To validate blocks, miners must stake their currencies. The length of the miners’ prior transaction validation history is also provided. Who validates each transaction is chosen at random by a weighted algorithm that considers stake and validation experience.

A miner receives bitcoin in addition to their initial stake when they validate a block and upload it to the chain. The miner’s stake or coins could be forfeited if the block is not successfully verified. Making miners put up a stake, which lessens their propensity to steal money or commit other fraud, creates an additional layer of safety.

As an alternative to proof-of-work, the proof-of-stake system was developed to address difficulties with scalability, energy consumption, and environmental effect.

The major disadvantage of proof of stake is the significant upfront cost needed to buy a network stake. Those with the most money may have the most control due to the algorithm weight utilized to choose the validator. Since there is no performance history, a validator receives a duplicate copy of the stake if a blockchain forks. If the validator accepts both bids on the split, they could be able to double-spend their coins.

PoW vs PoS: Features Compared

1. Energy Consumption

The quantity of electricity needed when comparing proof of stake with proof of work is one of the most significant discrepancies. The electricity use of cryptocurrencies is a major grievance from detractors. Because its authentication relies on powerful computers, proof of work takes substantially more energy.

For instance, the University of Cambridge calculates that Bitcoin, which involves proof-of-work mining, uses about.39% of the annual electricity used worldwide. Bitcoin mining consumes more electricity annually than both Finland and Belgium put together.

According to the Ethereum Foundation, this switch will use 99.95% less energy.

Since validators are selected by proof of stake rather than miners solving challenging puzzles, there is a massive reduction in energy consumption. Additionally, faster transaction times require less energy.

2. Demand For Electricity

Critics of cryptocurrencies frequently highlight the industry’s high electricity consumption and emissions. The proof of work consensus mechanism, which has grown to be a significant global electricity user, is the primary source of that energy requirement. For instance, Ethereum (ETH-USD) has a per-transaction energy cost of 50kWh or 26TWh per year, while Bitcoin (BTC-USD) has an energy cost per transaction of 830kWh or 130TWh per year.

An energy cost per transaction for a proof of stake cryptocurrency like Tezos (XTZ-USD) is only 30mWh, or 60MWh annually. Proof-of-work approaches use more energy than other models, making it challenging for miners to follow those protocols and be as profitable as other models because their costs for electricity and computing sometimes result in significantly smaller profit margins.

Proof-of-work programs also encounter scaling issues, which lengthen transaction times. As a result, ideas have been made to alter block sizes and utilize various transaction channels off the chain. However, many think that any fixes would only be short-term and bring further centralization, which many in the crypto community do not favor.

Contrarily, with proof of stake, validators are chosen randomly for each block, and the node is confirmed by consensus. That reduces energy burden and shortens transaction times, enabling quicker, more secure transactions and greater network scalability.

PoW vs PoS: Pros & Cons

Pros of PoW

- Proof-of-work was created to combat attempts to duplicate spending.

- It is among the safest consensus mechanisms.

- PoW-based cryptocurrencies have more mining power and are safer.

- In a standard PoW paradigm, mining rewards are earned.

Cons of PoW

- Powerful hardware is needed for mining.

- Not within the price range of any market participant.

- Energy use is through the roof due to the massive mining participation.

Pros of PoS

- For processing, proof of stake does not require expensive hardware.

- Faster and more reasonably priced transactions are made.

- PoS processing doesn’t require a lot of energy.

Cons of PoS

- PoS models have yet to be deployed on a complex blockchain.

- Taking over the network is simpler because it is financed.

- Many advantages of PoW, such as mining rewards, are lost with PoS.

PoW vs PoS: Security

Since miners must decipher the hash functions to generate or validate a new block, proof of work gives a high level of security. Proof of stake, however, also secures the network and locks the cryptocurrency. However, the security has frequently failed to pass stake-proof tests.

By forcing miners to compete with one another to solve cryptographic equations that certify each blockchain block, proof of work deters attacks. It depends on miners acting honestly and adhering to consensus laws.

A majority attack is a severe risk in proof of work networks. When a group has over 50% of the mining power, they can stop transactions from being completed, double spend, and fork the blockchain, making several copies of the blockchain appear legitimate.

Attackers are encouraged to confirm legal transactions and steer clear of forking the blockchain because they would forfeit their stake as proof of stake only permits miners to validate blocks if they have paid a “stake” or security deposit. Given that there is no incentive for attackers to interfere with the blockchain to steal or double-spend money, proof of stake can therefore be a helpful method of preventing cryptocurrency attacks.

PoW vs PoS: Cost

Blumberg states, “Proof of stake is substantially more energy efficient.” “Ethereum and other blockchains seek to power a decentralized finance ecosystem on a large scale, but there isn’t enough energy on the planet to do that.”

PoW vs PoS: Transaction Time

Experts claim that proof of stake has several advantages over proof of effort. Faster transaction speeds and more energy-efficient energy requirements allow for more scalable blockchains that are easier to adopt by new users. Additionally, proof of stake offers chances to increase one’s cryptocurrency earnings.

PoW vs PoS: Other Differences Explained

Tools Needed

The proof of work consensus mechanism utilizes powerful machinery, such as computers with GPUs and hard drives. The computer must be highly efficient to carry out these mining tasks.

However, because the expensive computation of Nonce value bus complicated activity is avoided, Proof of Stake does not need any tools or equipment.

Rewards

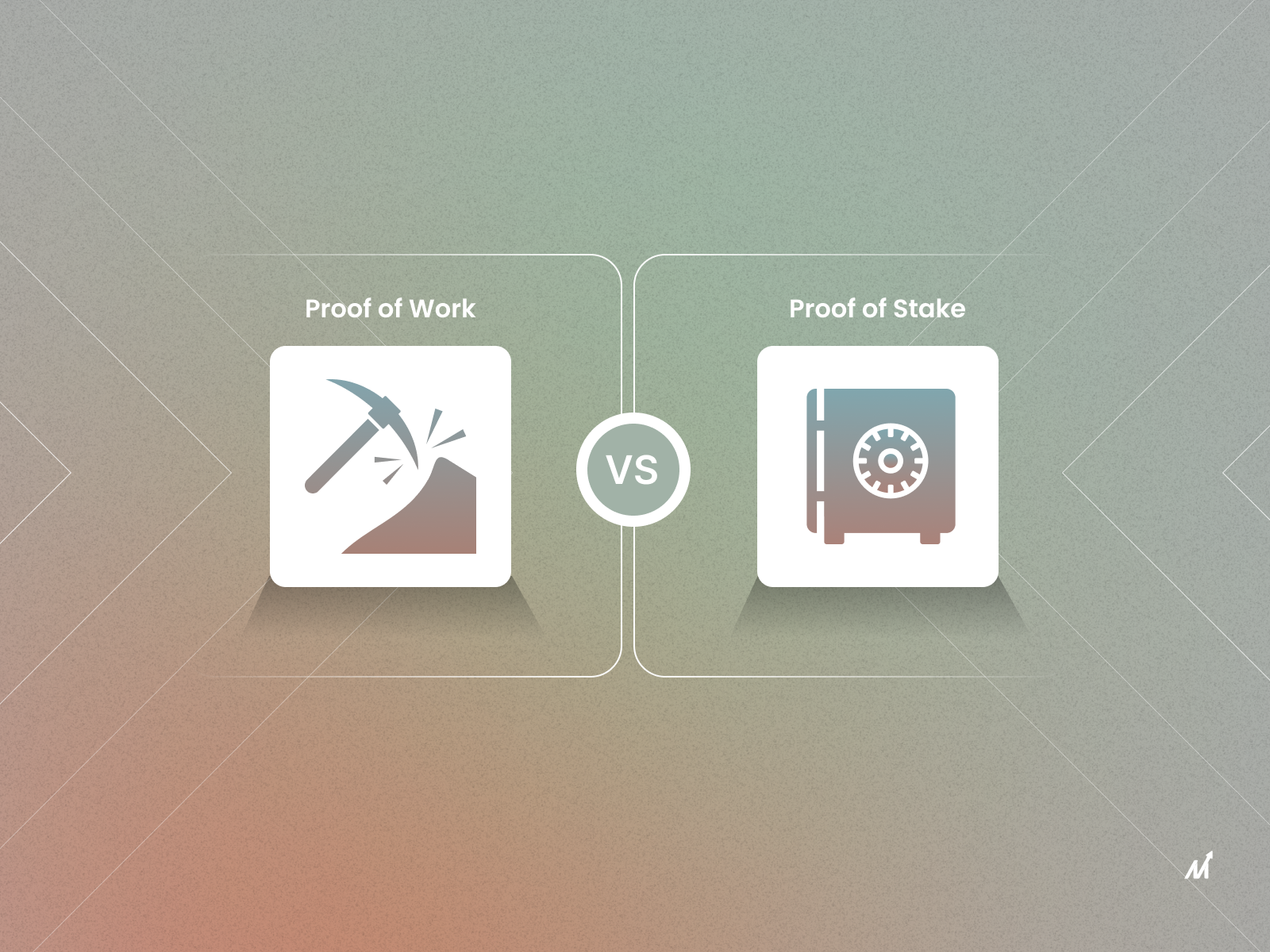

Under the Proof of Work system, rewards are given to the first miner to answer the equation correctly. The awards are paid for with bitcoin. However, block or coin incentives are absent from Proof of Stake. The validators, therefore, take the transaction costs in their place.

PoW vs PoS: Table Of Comparison

| PoW | PoS | |

| 1. | The miner’s computer workload influences the possibility of mining a block. | The possibility of validating a new block depends on the magnitude of a person’s stake (how many coins they possess). |

| 2. | A reward is given to the first miner to solve the cryptographic puzzle of each block. | Instead of receiving a block reward, the validator is compensated with network fees. |

| 3. | To add each block to the chain, miners must compete to use their computer processing power to decipher challenging puzzles. | Since a user-stake-based mechanism chooses the block developer, there is no competition. |

| 4. | Hackers must have 51% computing power to add a malicious block. | It is virtually hard for hackers to possess 51% of all cryptocurrency on the network. |

| 5. | Systems using proof of work are less economical and energy efficient, but they are more reliable. | Systems using Proof of Stake have less proof but are significantly cheaper and more energy efficient than POW systems. |

| 6. | Specialized equipment to optimize processing power. | A standard server-grade unit is more than enough. |

| 7. | The initial investment is to buy hardware. | The initial investment is to buy a stake and build a reputation. |

| 8. | Bitcoin is the most well-known crypto with a Proof-of-Work consensus-building algorithm that uses the most well-known proof-of-work function called SHA256. | Some cryptocurrencies that use different variants of proof-of-stake consensus are EOS (EOS), Tezos (XTZ), Cardano (ADA), Cosmos (ATOM), and Lisk (LSK). |

PoW vs PoS: Verdict – Markovate’s Take

Cryptocurrencies employ proof of work and proof of stake blockchain, two distinct techniques, to agree on what new blocks should be added to their blockchains. Each one addresses the fundamental issue of transaction verification without the aid of a centralized authority.

Proof of stake achieves consensus by asking participants to stake bitcoin behind the new block they wish to be added to a cryptocurrency’s blockchain. On the other hand, proof of work creates consensus by asking users to use computational resources, including electricity, to create a new valid block.

Proof of work has the benefit of making network attacks on cryptocurrencies more expensive, but it has a rising environmental cost. Proof of stake doesn’t require the same energy as proof of work, but it has yet to be shown as secure and stable.

PoW vs PoS: FAQs

1. What is a validator in proof of stake?

A validator is a proof of stake network node that handles transactions, stores data, and adds new blocks to the blockchain.

2. Can the proof of stake be hacked?

The main risk associated with PoS is hacking the delegation of authority over currency staking. Even when the staking power is being utilized to launch assaults against the network, you could still possess the cryptocurrency. As a result, network centralization would occur, defeating the purpose of decentralized blockchains.

3. Is PoW more profitable than PoS?

Advocates for proof of stake assert that PoS is financially safer than PoW in terms of proof of work vs. proof of stake blockchain.