Ethereum Merge: Introduction

According to the Ethereum Foundation, the long-awaited Ethereum Merge event is scheduled to take place and is expected to cut the Blockchain’s energy consumption by 99%.

With the six-year-old update, Ethereum’s Proof-of-Work consensus algorithm will be replaced with a Proof-of-Stake one. This implies that transaction costs, or “gas prices,” would decrease, and the network could quickly handle transactions.

Given that the Blockchain includes hundreds of billions of dollars worth of value, some have dubbed the Merger the most significant crypto event since the inception of ether and bitcoin. NFTs and smart contracts, two of the most popular crypto-related applications, are supported by Ethereum.

To enable speedier processing, the Ethereum network would effectively split into smaller data blocks, giving rise to the so-called Ethereum 2.0, which intends to process 100,000 transactions per second. Approximately 30 transactions can be handled per second by Ethereum at the moment.

When will the Merge happen?

Although there is no specific date for The Merge, the changeover has already been accomplished on Ethereum testnets. You may consider each testnet Merge as a practice run for the big event. These test runs were successful, and the Ethereum Mainnet can now launch The Merge. This is going to happen on September 15, 2022, according to Ethereum developers.

What exactly is the Merge?

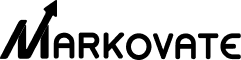

The Merge reflects the union of Ethereum’s existing execution layer (the Mainnet we use today) and the Beacon Chain, its new Proof-of-Stake consensus layer. It replaces energy-intensive mining with staked ETH to safeguard the network. A tremendously exciting step toward attaining Ethereum’s aim of increased scalability, security, and sustainability.

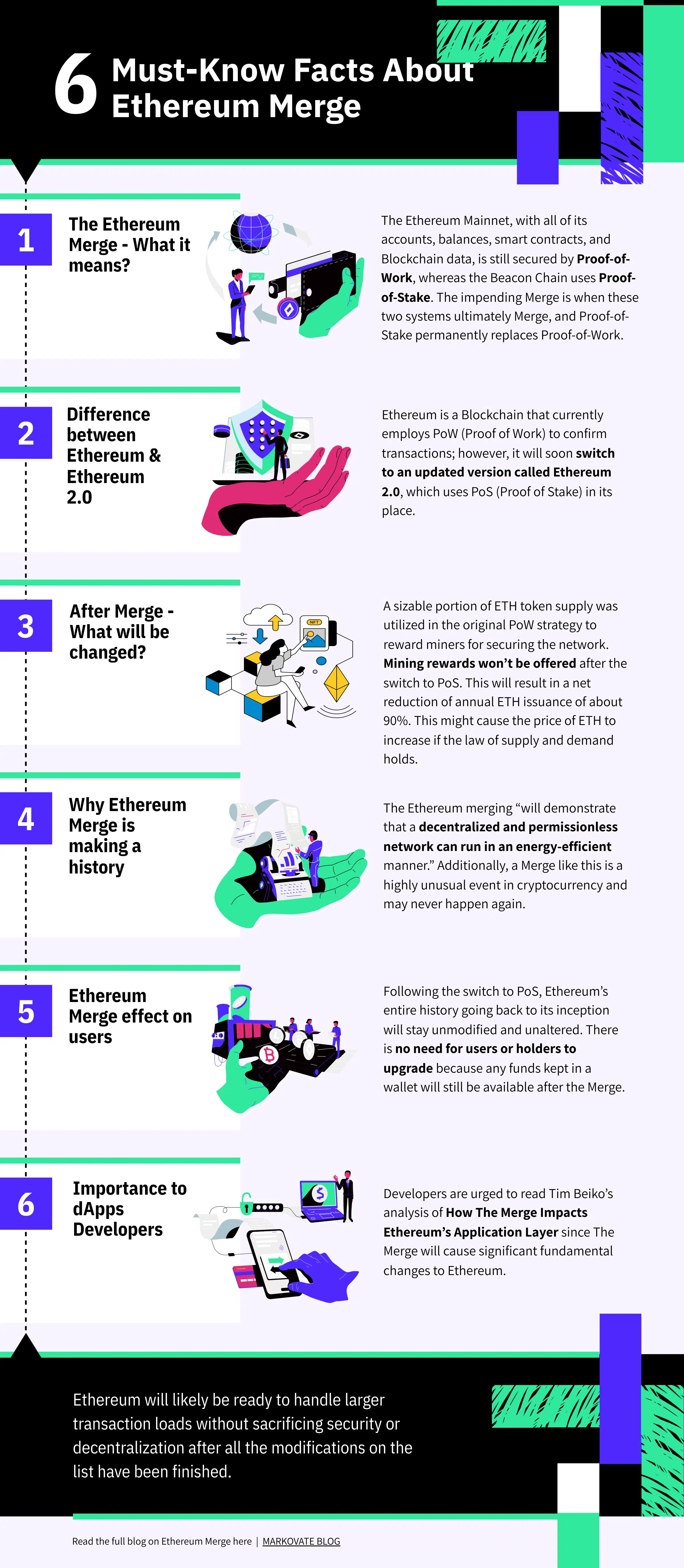

It’s vital to recall that the Beacon Chain was initially distributed independently of Mainnet. The Ethereum Mainnet, with all of its accounts, balances, smart contracts, and Blockchain data, is still secured by Proof-of-Work, whereas the Beacon Chain uses Proof-of-Stake. The impending Merge is when these two systems ultimately Merge, and Proof-of-Stake permanently replaces Proof-of-Work.

The Beacon Chain: Processing engine of Ethereum 2.0

The Beacon Chain is the foundation on which Ethereum 2.0 is built. It operates concurrently with the Ethereum network as a separate Blockchain. Despite not processing any transactions on the Mainnet, it has reached agreements on its own. By settling on active validators’ account balances, this occurs.

In contrast to Ethereum’s Mainnet, which continues to use a Proof-of-Work consensus method, the Beacon Chain is protected by a Proof-of-Stake consensus mechanism. On December 1, 2020, it was established.

As of now, Ethereum 2.0 has been tested on the Beacon Chain. However, with the Merge, everything is set to change.

This has several significant ramifications for the network, but the following are the most important ones:

- No history will be lost

- Funds are safe

- No more mining of ETH

What happens shortly following the Ethereum Merge?

Once completed, Ethereum’s classic Proof-of-Work methodology will be permanently abandoned, and the currently active Beacon Chain will be responsible for validating new transactions through Proof-of-Stake.

Over 13 million ETH have been staked on the Beacon Chain by validators as of this writing. The whole transaction history of Ethereum, including each transaction, smart contract, and balance since July 2015, will be Merged as the Mainnet (the leading network of the Ethereum Blockchain) and the Beacon Chain are Merged.

Why does the Ethereum Merge matter?

Due to the possible material and philosophical ramifications, The Merge, which has been six years in the making, is regarded by many as a turning point in the history of cryptocurrencies.

After months of market instability brought on, among other things, by inflation and rising interest rates, this milestone might help boost market confidence and infuse some much-needed optimism.

The Ethereum merging “will demonstrate that a decentralized and permissionless network can run in an energy-efficient manner.” Additionally, a Merge like this is a highly unusual event in cryptocurrency and may never happen again.

Further Read: Build a Blockchain Application: All-in-One Tech Guide

How to prepare for the Merge?

Given that this is one of the most significant occasions in the history of the cryptocurrency sector, it is expected that many unscrupulous persons would try to take advantage of it to defraud trusting individuals of their money. This is why it’s crucial to understand that ETH users and holders don’t need to make any changes to their accounts or funds before the Merge.

Following the switch to PoS, Ethereum’s entire history going back to its inception will stay unmodified and unaltered. There is no need for users or holders to upgrade because any funds kept in a wallet will still be available after the Merge.

Despite this, other players in the Ethereum ecosystem besides users and holders exist.

1. Staking node operators and providers

Running a consensus layer client and an execution layer initially are the most crucial tasks to do if you are running a staking node. For them to communicate securely, you should authenticate both levels using a common JWT secret. Also, you should set up a fee recipient address to receive tips from your transactions.

2. None-validating node operators and providers of infrastructure

Installing a consensus layer client in addition to the execution layer client is the primary action here. Once more, you must use a shared JWT secret to verify both clients before allowing them to speak with one another in secret.

3. Smart contract and DApp developers

Developers are urged to read Tim Beiko’s analysis of How The Merge Impacts Ethereum’s Application Layer since The Merge will cause significant fundamental changes to Ethereum.

Is Proof-of-Stake better than Proof-of-Work?

PoS will reduce Ethereum’s energy consumption by around 99.95%, according to the Ethereum Foundation, a nonprofit organization that sponsors the growth of the Ethereum ecosystem.

PoS proponents contend that PoW mining concentrates power in the hands of those who can afford to purchase expensive crypto mining equipment known as ASICs. According to them, PoS, which grants network control to users who “stake” cryptocurrency, renders attacks both economically unviable and self-defeating.

PoS staking, in contrast, has its centralization and security problems, according to PoW proponents, opening the door for malevolent actors to directly “purchase” control of the network. Additionally, they note that PoS is a less tried-and-true approach than PoW, which is the foundation of the two most extensive Blockchain networks and has shown to be durable.

After the Merge, will Ethereum users or ETH holders need to take action?

You won’t need to claim fresh “PoS ETH” or “ETH2” tokens if you currently have ether (ETH). After the Merge, your balance will stay precisely the same, and you can continue utilizing the network as usual.

Users of Ethereum won’t need to do anything following the Merge. Still, Ethereum software vendors and node operators (the people running the Ethereum network machines) will need to upgrade their software to ensure they are interacting with the most recent version of the network.

The Merge’s impact on ETH

Ethereum debuted with an initial supply of 72 million ether as one of the most well-known second-generation Blockchain initiatives (ETH). A sizable portion of this token supply was utilized in the original PoW strategy to reward miners for securing the network.

Mining rewards won’t be offered after the switch to PoS. This will result in a net reduction of annual ETH issuance of about 90%. This might cause the price of ETH to increase if the law of supply and demand holds. Nevertheless, other factors are at play, and financial markets are unpredictable and volatile.

Further Read: Comprehensive Business Guide For All Your Blockchain App Development Needs

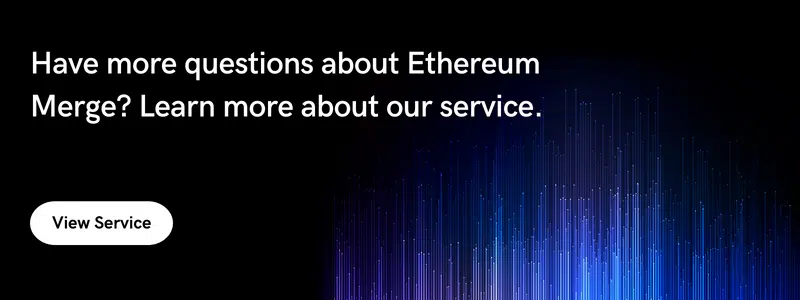

The top 5 myths about the Ethereum Merge

Like other highly anticipated and significant events, many myths are pervasive in cryptocurrency. The five most typical ones are listed below.

1. It requires staking 32 ETH to run a node

On the Ethereum network, there are two kinds of nodes: those that can suggest blocks and those that can’t. Even though they do not propose partnerships since they are not obligated to commit ETH, these individuals are crucial to the network’s security because they hold all block proposers accountable.

2. The Ethereum Merge will result in overall network downtime

It is planned that there will be no downtime during the Merge upgrade. It should always be possible for the network to continue operating as intended.

3. All staked ETH will be withdrawn after the Merge

The rate at which validators leave the network is capped. Security considerations drive this action. Restrictions are permitting about 43,200 ETH to escape each day. At the time of writing, more than 13 million ETH are staked.

4. Transaction speed will increase greatly

Even after the integration, transaction processing times on the Mainnet will remain unchanged, with a few minor exceptions.

5. Gas fees will fall after the Merge

There won’t be a reduction in gas prices as a result of the Merge because it won’t increase network capacity and instead affect the consensus method as a whole. However, there are scaling strategies under development that are intended to accomplish that; most of them are geared for layer 2s.

Conclusion

The Merge is the second in a series of substantial improvements to the Ethereum network. Getting ready to implement new scaling ideas was suggested for better scalability.

Ethereum Merge: Infographic

ETH will likely be ready to handle larger transaction loads without sacrificing security or decentralization after all the modifications on the list have been finished.

Ethereum Merge: FAQs

1. Is Ethereum and Ethereum 2.0 the same?

Ethereum is a Blockchain that currently employs PoW (Proof of Work) to confirm transactions; however, it will soon switch to an updated version called Ethereum 2.0, which uses PoS (Proof of Stake) in its place.

2. How many Ethereum are there?

However, the supply of Ethereum is limitless. The number of tokens in use in January 2021 was 113.5 million. There are approximately 120 million as of April 2022. According to specific forecasts, the amount of Ethereum in circulation could decline once the PoS one replaces the PoW Ethereum process.

3. What will ETH 2.0 do?

Major Takeaways. By switching from the Proof-of-Work (PoW) concept to Proof-of-Stake (PoS), Ethereum 2.0 represents a significant improvement for the Ethereum network. The network’s scalability, accessibility, and security are all goals of Ethereum 2.0.